America’s 2025 Budget: What It Means for the Average Citizen

Introduction

Every year, the United States government creates a budget that decides how the country will spend its money and collect revenue. The 2025 federal budget is especially important because it impacts everyday Americans — from healthcare and taxes to education and social services. Understanding this budget helps citizens know what changes to expect, plan their finances, and make informed decisions.

In this article, we will break down the key points of the 2025 budget, explain its effects on the average person, and provide tips to manage the impact of these changes. Everything is explained in simple, easy-to-understand words for everyone.

What Is the Federal Budget?

The federal budget is a financial plan for the government. It shows how much money the government will collect (income) and how it will spend (expenditure) over the fiscal year.

The budget has two main types of spending:

-

Mandatory Spending: Programs that the government must pay for by law, like Social Security, Medicare, and Medicaid. These are automatic and do not require yearly approval.

-

Discretionary Spending: Programs that the government can adjust every year, like defense, education, infrastructure, and environmental programs.

In 2025, the U.S. government plans to spend approximately $6.66 trillion. This money will come from taxes, fees, and other government income sources.

Key Provisions for the Average Citizen

The federal budget affects millions of Americans directly and indirectly. Let’s look at the most important areas:

1. Healthcare

Healthcare is one of the biggest expenses for Americans. The 2025 budget includes plans that could change how much citizens pay for health insurance and medical services.

-

Affordable Care Act (ACA) Subsidies: These subsidies help lower-income Americans buy health insurance. Some proposals may reduce these subsidies, which could make insurance more expensive for many families.

-

Medicaid Funding: Medicaid provides health coverage for low-income families, seniors, and people with disabilities. The 2025 budget may limit funding for some Medicaid programs, which could affect the availability of services.

Impact: Many families could face higher premiums or reduced access to doctors and hospitals. It is important to plan for potential healthcare cost increases.

2. Taxes

Taxes are central to the federal budget. The 2025 budget contains proposals that may affect your wallet.

-

Corporate and High-Income Tax Cuts: Businesses and high earners may pay less tax, which supporters say encourages investment. Critics argue this increases the gap between the rich and the poor.

-

Child Tax Credit Expansion: The budget includes an increase in the Child Tax Credit to help families with children cover expenses like food, clothing, and school supplies.

-

Income Tax Adjustments: Some brackets may see slight changes, but most middle-income families may not notice large differences.

Impact: Families with children may benefit from the child tax credit. High earners and corporations will save on taxes, while low-to-middle-income Americans may see little change in their personal tax bills.

3. Social Services

Social services provide a safety net for low-income Americans. The 2025 budget includes changes that could affect these programs:

-

SNAP (Food Stamps): This program helps families afford groceries. Potential reductions in funding could make it harder for some households to meet daily food needs.

-

Housing Assistance: Funding for affordable housing programs may change, affecting families who rely on government-subsidized housing.

-

Unemployment Benefits and Job Training: The budget supports job training programs to help citizens find employment, but some programs may face cuts.

Impact: Low-income households could experience challenges in covering basic necessities like food, rent, and utilities. Planning ahead is crucial for families dependent on these programs.

4. Education

Education funding affects students, teachers, and families. The 2025 budget proposes:

-

K-12 Schools: Continued funding for public schools with some adjustments. Budget cuts may affect programs like arts, sports, or technology in classrooms.

-

Higher Education: Support for colleges and universities may change. Some scholarships and grants could increase, while other programs may face cuts.

-

Student Loans: The budget may include adjustments to student loan repayment programs, potentially easing or changing repayment plans for borrowers.

Impact: Families with school-going children may see minor changes in school programs. College students and borrowers need to track updates to student loan programs.

5. Infrastructure and Transportation

The budget invests in roads, bridges, airports, and public transit. These projects can improve daily life and create jobs.

-

Roads and Bridges: Repair and upgrade projects may reduce commute times and improve safety.

-

Public Transit: Investments in buses, trains, and subways make commuting easier, especially in cities.

-

Digital Infrastructure: Expansion of high-speed internet and technology in rural areas is included.

Impact: Better roads, bridges, and internet access benefit everyone, from students to workers. Infrastructure projects also create new job opportunities.

6. Environment and Climate

Environmental programs are part of the 2025 budget. These efforts aim to reduce pollution, protect wildlife, and address climate change.

-

Clean Energy Investments: Funds for solar, wind, and electric vehicle initiatives may grow.

-

Conservation Programs: National parks and wildlife protection receive support.

-

Pollution Reduction: Projects to reduce air and water pollution help improve public health.

Impact: Citizens benefit from cleaner air, water, and new green jobs. Long-term climate actions can reduce energy costs and improve quality of life.

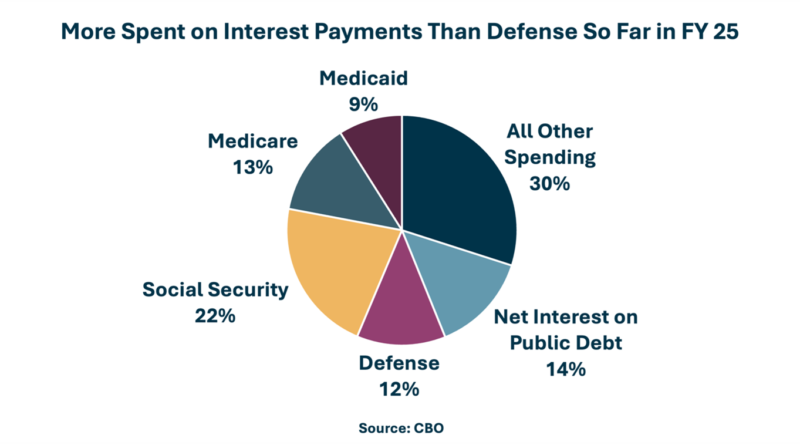

7. Defense and National Security

Defense spending is a significant part of the budget, but its direct impact on everyday Americans is less obvious. However:

-

Military Funding: Ensures national security and global presence.

-

Veterans’ Services: Healthcare, pensions, and housing support for veterans continue to receive funding.

Impact: Families with military members benefit from continued veterans’ services. National security helps maintain stability, indirectly benefiting all citizens.

Potential Challenges for Citizens

The 2025 budget may also bring some challenges:

-

Higher Healthcare Costs: Reduced subsidies or Medicaid changes may increase out-of-pocket expenses.

-

Changes in Social Services: Cuts to SNAP, housing, or unemployment programs can affect low-income families.

-

Tax Inequality: High earners may benefit more than middle or low-income households.

-

Education Adjustments: Cuts in school funding may impact extracurricular programs or new technology in classrooms.

Being aware of these challenges helps families plan their finances, healthcare, and education.

Tips for the Average Citizen

To navigate the impact of the 2025 federal budget, here are some practical tips:

-

Track Your Budget: Adjust household expenses to account for potential changes in taxes, healthcare, and social benefits.

-

Stay Informed: Follow news and official announcements regarding budget changes.

-

Plan for Healthcare: Review health insurance plans and consider how changes in subsidies or Medicaid may affect costs.

-

Prepare for Education Costs: If you have school-going children, check for changes in funding, scholarships, or grants.

-

Explore Benefits: Make sure you are using all available tax credits, housing programs, and food assistance options.

-

Invest in Skills: Job training and education programs may be affected, so improving skills proactively can help with career stability.

Conclusion

The 2025 U.S. federal budget is a plan that affects nearly every aspect of life for the average American. From healthcare, taxes, and social services to education, infrastructure, and the environment, the budget outlines where government money will go and how it will be collected.

For everyday citizens, this budget may mean:

-

Changes in healthcare costs and insurance options.

-

New opportunities through child tax credits and scholarships.

-

Adjustments in social programs like SNAP and housing assistance.

-

Improvements in infrastructure, internet access, and public transportation.

-

Investments in clean energy and environmental protection.

By staying informed, reviewing personal finances, and planning ahead, Americans can better navigate these changes. While some aspects of the budget may bring challenges, others create opportunities for families, students, and workers across the country.

Being proactive, using available benefits, and adjusting household plans will help every citizen adapt to the 2025 federal budget. Knowledge is power, and understanding the budget ensures you can make the best choices for your family and future.