Banking Sector 2025: The Rise of FinTech

Introduction

The banking world is changing faster than ever. In just a few years, technology has transformed how people save, send, and spend money. From mobile banking apps to online wallets and digital payments, financial technology — known as FinTech — is shaping the future of the banking sector.

As we enter 2025, the line between banks and technology companies is becoming thinner. Banks are learning from FinTech startups, and startups are learning how to manage trust, security, and scale like banks. Together, they are building a smarter, faster, and more customer-friendly financial world.

This article explores how the banking sector is evolving in 2025, what FinTech really means, and how it is changing the way we handle money — all explained in easy, simple English.

What is FinTech?

FinTech stands for Financial Technology. It means using technology to offer financial services in new and better ways.

A few simple examples:

-

Using an app to transfer money instantly.

-

Paying bills online without visiting a bank.

-

Investing in stocks through your phone.

-

Applying for a loan within minutes using digital verification.

FinTech combines finance and innovation to make banking more accessible and efficient. Instead of waiting in long lines or filling out piles of paperwork, people can now manage their entire financial life through their smartphone.

The Banking Sector Before FinTech

Before FinTech, banking was slow and mostly manual. People had to visit branches for almost everything — from opening an account to transferring money.

Some of the common challenges were:

-

Long waiting times at bank counters.

-

Limited branch hours (closed on weekends).

-

Complicated paperwork for loans or services.

-

Slow money transfers, especially international ones.

-

Limited options for people without access to traditional banks.

While banks were safe and trusted, they weren’t always convenient. FinTech solved this problem by bringing technology into the financial world.

The Rise of FinTech: A Global Shift

Between 2015 and 2025, the world saw an explosion of FinTech startups. These companies used apps, data, and digital tools to offer faster, cheaper, and simpler financial services.

By 2025, almost every person with a smartphone has used a FinTech service — even if they don’t realize it. Whether paying through Google Pay, sending money via PayPal, or checking credit scores online, FinTech is now part of daily life.

Key Reasons Behind the Rise of FinTech

-

Smartphone Revolution: Millions of people now use mobile phones for everything — including money management.

-

Internet Access: High-speed internet has made online transactions quick and secure.

-

Digital Payments: People prefer cashless transactions for safety and ease.

-

COVID-19 Effect: The pandemic pushed people toward contactless payments and online banking.

-

Innovation and Competition: Startups introduced fresh ideas, forcing traditional banks to modernize.

How FinTech is Changing Banking in 2025

Let’s look at how exactly FinTech is reshaping the banking sector this year:

1. Digital Payments and Wallets

Mobile wallets like Apple Pay, Google Pay, and Paytm have become part of everyday life. People use them for grocery shopping, travel bookings, and even small local payments.

Banks are now creating their own digital wallets to stay relevant. In 2025, cashless payments are becoming the norm, not the exception.

2. Online Banking and Virtual Branches

Physical branches are no longer the only way to bank. Many people open accounts, apply for loans, and manage savings completely online.

Some banks now operate virtual branches, where customers can chat with representatives using video calls or AI-based chatbots.

3. Artificial Intelligence (AI) in Banking

AI helps banks provide better and faster services. For example:

-

AI chatbots answer customer questions instantly.

-

Fraud detection systems identify unusual activity in seconds.

-

Personalized recommendations help customers make smarter financial decisions.

AI saves time for both banks and customers while improving safety.

4. Blockchain and Secure Transactions

Blockchain technology — the same technology behind cryptocurrencies — is now being used by banks for secure transactions. It ensures transparency, reduces fraud, and speeds up global payments.

In 2025, many banks are exploring blockchain-based systems to improve international money transfers and data security.

5. Open Banking

Open banking allows customers to connect different financial accounts safely. It means users can manage savings, loans, investments, and credit cards all in one app.

This idea gives customers more control over their data and lets them choose services from multiple providers — not just one bank.

6. Digital Lending and Instant Loans

In the past, getting a loan could take weeks. In 2025, FinTech platforms can approve small loans within minutes using AI and digital records.

Digital lending uses technology to check your credit score, employment, and bank details automatically — no paperwork needed.

7. Financial Inclusion

FinTech is helping millions of people who never had access to banks before. Through mobile apps, even those in rural or remote areas can save money, send payments, or get microloans.

This is especially important for developing countries, where FinTech is closing the gap between urban and rural banking.

How Banks Are Adapting to FinTech

Instead of seeing FinTech as a threat, many banks are now partnering with FinTech companies. They understand that customers want fast, digital solutions — and technology helps them deliver that.

Here’s how banks are adapting in 2025:

-

Creating Digital Banking Divisions – Many banks now have dedicated digital teams to design user-friendly mobile apps.

-

Collaborating with FinTech Startups – Banks are teaming up with startups to launch new services quickly.

-

Investing in Cybersecurity – With more digital users, protecting customer data is a top priority.

-

Launching Innovation Labs – Banks are experimenting with AI, blockchain, and automation inside special tech labs.

-

Focusing on Customer Experience – Modern banking is less about paperwork and more about user experience.

Challenges Ahead for the Banking Sector

Even though FinTech has created great opportunities, there are still challenges that need to be managed carefully.

1. Cybersecurity Risks

As more transactions move online, the risk of hacking and fraud increases. Banks and FinTech firms must invest heavily in cybersecurity to protect user data.

2. Regulatory Issues

Different countries have different financial laws. Regulators are still learning how to monitor FinTech while encouraging innovation.

3. Customer Trust

People trust traditional banks because of their history and stability. FinTech companies need to keep building that same level of trust.

4. Market Competition

There are thousands of FinTech apps and banks now offering similar services. Staying unique and secure is a big challenge.

5. Job Shifts

Automation and digital banking are reducing the need for traditional bank staff. The sector must help workers learn new digital skills.

The Future of Banking and FinTech

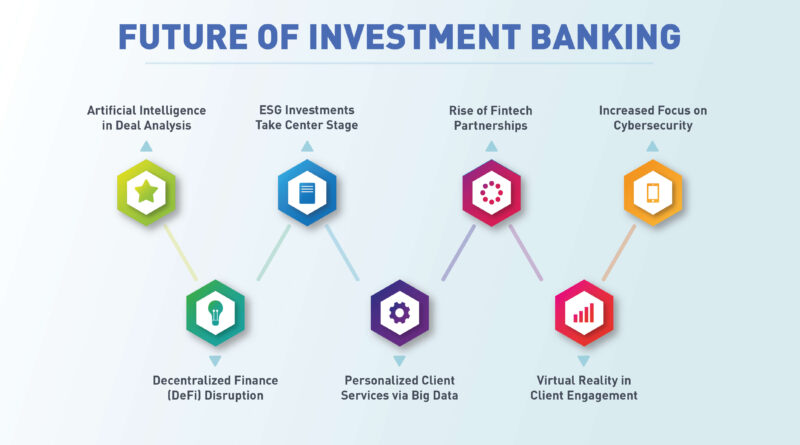

Looking ahead, 2025 is just the beginning. The future of banking will be shaped by deeper use of technology.

Here’s what experts predict:

-

More AI integration: Smarter systems will predict customer needs automatically.

-

Stronger security: Biometric systems like face and fingerprint recognition will be common.

-

Central Bank Digital Currencies (CBDCs): Governments may launch their own digital money to compete with cryptocurrencies.

-

Eco-friendly finance: Green banking and paperless services will grow.

-

Personalized banking: Customers will get custom offers based on behavior and goals.

FinTech is not replacing banks — it’s redefining them. The two will continue working together to create a faster, fairer, and more inclusive financial system.

Conclusion

The rise of FinTech has changed the way the world sees banking. What once required physical branches and long queues can now be done in seconds on a phone.

In 2025, the banking sector is smarter, digital, and more customer-focused than ever before. FinTech has not only made life easier but also opened the door for millions of people to join the financial system for the first time.

The future of banking will be built on technology, trust, and transparency. Those banks and startups that continue to innovate — while keeping customer safety and satisfaction at the center — will lead the next generation of global finance.

FinTech’s rise is not just a trend. It’s a revolution — and it’s here to stay.