Wealth Management Explained: Asset Protection, Estate Planning, and Inheritance Made Simple

Introduction

Financial planning is like drawing a map for your money. It helps you decide how to spend, save, protect, and grow your income so that your present feels secure and your future stays comfortable.

Three important building blocks of financial planning are:

-

Tax Planning – reducing the amount you legally owe in taxes.

-

Retirement Planning – preparing for life after work.

-

Insurance – protecting your money from sudden risks.

Let’s break each one down clearly and deeply.

1. Tax Planning – Paying Only What You Should

Tax planning means arranging your income and investments so that you don’t pay more tax than necessary. It doesn’t mean avoiding tax — it means using legal rules and benefits smartly.

Why It Matters

-

The less you spend on taxes, the more money you keep for your own goals.

-

Good tax planning makes saving and investing easier.

Common Ways People Plan Taxes

-

Retirement contributions: Putting money in retirement accounts can lower your taxable income today.

-

Claiming deductions and credits: Many governments allow you to reduce taxable income for things like medical expenses, education, or housing loans.

-

Business expenses: If you own a business, keeping records of office costs, travel, or equipment can help reduce taxable income.

-

Timing: Sometimes shifting income or expenses from one year to another reduces your tax bill.

Example

If you earn $40,000 and put $4,000 into a retirement account, you are taxed only on $36,000. That’s instant savings while still building your future.

2. Retirement Planning – Saving for Life After Work

Retirement planning means preparing for the day when you no longer earn a regular paycheck. The money you save and invest today becomes the income you will depend on tomorrow.

Why It Matters

-

Salaries eventually stop, but living expenses continue.

-

Health costs usually rise with age.

-

Depending only on government pensions is risky.

How People Prepare for Retirement

-

Workplace retirement plans: Many employers provide savings programs and sometimes even add extra money (called a “match”) to what you save.

-

Personal retirement accounts: Special accounts you open yourself that may give tax benefits.

-

Investments: Putting money in stocks, bonds, or real estate so it grows over time.

The Power of Starting Early

If a 25-year-old saves just $150 a month with a 7% average return, by age 65 they could have over $350,000. But if they start at 35 with the same amount, they’ll end up with less than half. Time is the biggest friend of retirement savings.

3. Insurance – A Shield Against the Unexpected

Insurance is not about earning money — it is about protecting the money you already have. It works like this: you pay small amounts regularly (called premiums), and in return, the insurance company promises to cover big unexpected costs.

Why It Matters

-

Emergencies can destroy years of savings.

-

Without insurance, one accident, illness, or disaster can push a family into debt.

Common Types of Insurance

-

Health insurance: Pays for hospital bills and medical care.

-

Life insurance: Provides money to your family if you pass away.

-

Property insurance: Protects homes, cars, or valuable belongings from damage or theft.

-

Disability insurance: Replaces your income if you can’t work due to sickness or injury.

Example

Imagine a surgery costs $20,000. Without health insurance, you pay everything yourself. With insurance, you may only pay a small part, like $1,000, while the insurer covers the rest. That one policy saves your savings.

Conclusion

Financial planning is about balance:

-

Tax planning helps you keep more of what you earn.

-

Retirement planning ensures a comfortable life after you stop working.

-

Insurance protects you from risks that could wipe out your hard work.

When you put these three together, you build a strong foundation: money saved from taxes, money prepared for the future, and money protected from unexpected losses.

Introduction

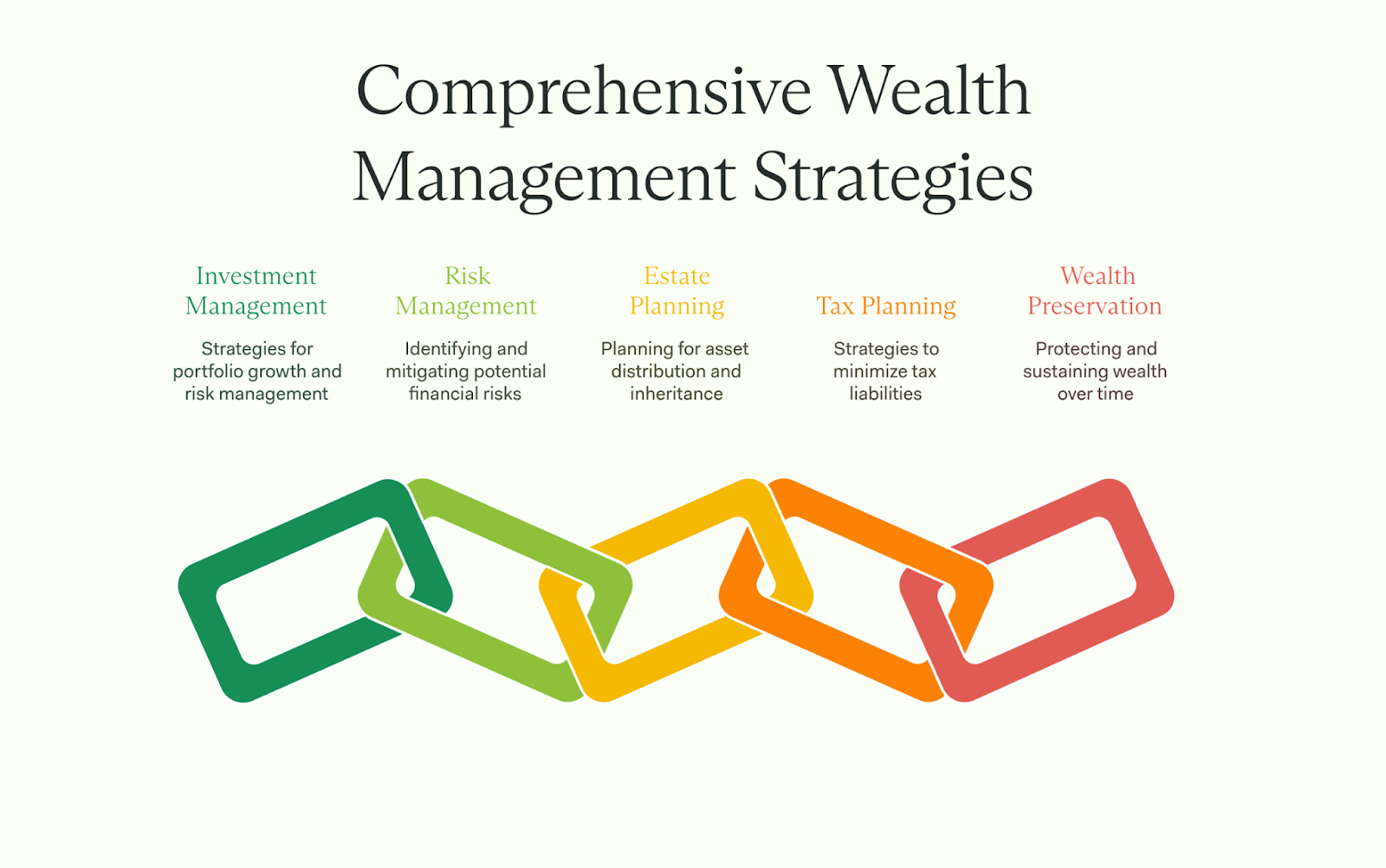

Wealth management is not only for the rich — it is for anyone who wants to protect, grow, and smoothly transfer their money and property. The goal is simple: keep your wealth safe today and pass it on wisely tomorrow.

Three important parts of wealth management are:

-

Asset Protection

-

Estate Planning

-

Inheritance

Let’s explore each one in detail.

1. Asset Protection – Keeping Your Wealth Safe

Asset protection means taking steps to keep your money, property, and valuables safe from risks.

Why It Matters

-

Life is unpredictable. Accidents, lawsuits, debts, or even bad business decisions can threaten your assets.

-

Without protection, you could lose years of savings in a single event.

Common Strategies

-

Insurance: Health, life, property, and liability insurance cover unexpected losses.

-

Legal structures: Many people use trusts, LLCs (Limited Liability Companies), or corporations to separate personal assets from business risks.

-

Diversification: Don’t put all your money in one place. Spread it across banks, investments, and property.

Example

Imagine you own a small business. If the business fails, creditors could try to take your personal savings. But if you placed your business under an LLC, your personal assets (like your house) would remain safe.

2. Estate Planning – Deciding What Happens After You

Estate planning is about making decisions for your money and property in case of disability or death. It is not just for the wealthy — anyone who owns something valuable should plan their estate.

Why It Matters

-

Ensures your family is taken care of.

-

Prevents conflicts among relatives.

-

Reduces taxes and legal delays.

Key Tools in Estate Planning

-

Will: A legal document where you state who gets what after you pass away.

-

Trusts: Arrangements that hold your assets for your chosen beneficiaries, often with tax benefits.

-

Power of Attorney: Appointing someone you trust to handle financial or medical decisions if you cannot.

-

Healthcare directives: Instructions about medical treatment if you are seriously ill.

Example

Without a will, the court decides how your assets are divided. This can take months or even years, and family members may argue. A simple written will avoids such problems.

3. Inheritance – Passing Wealth to the Next Generation

Inheritance is the process of transferring your wealth (money, property, or valuables) to your heirs after your death.

Why It Matters

-

Inheritance is more than money — it represents your life’s work.

-

Without proper planning, inheritance can lead to family disputes or heavy taxes.

Key Considerations

-

Fair distribution: Decide how to divide assets among children or heirs in a way that feels just.

-

Taxes: In some countries, inheritance is taxed. Smart planning can reduce this burden.

-

Education: Teach your children how to manage wealth responsibly, so they don’t waste what they inherit.

Example

A parent leaves behind property and bank savings. If no inheritance plan exists, siblings may fight over ownership. But if the parent clearly mentioned distribution in a will or trust, the process is smooth and conflict-free.

Conclusion

Wealth management is about protection, planning, and passing on.

-

Asset protection keeps your wealth safe during your lifetime.

-

Estate planning organizes how your wealth will be managed if you are gone or unable to decide.

-

Inheritance planning ensures your loved ones benefit fairly and peacefully from your life’s work.

By thinking ahead and setting up the right plans, you not only safeguard your money but also give your family peace of mind.